In accordance with Vaneck, excessive lipids utilized in large-scale adoption and decentralized spinoff exchanges resulted in a major enhance in excessive lipid community revenues in July.

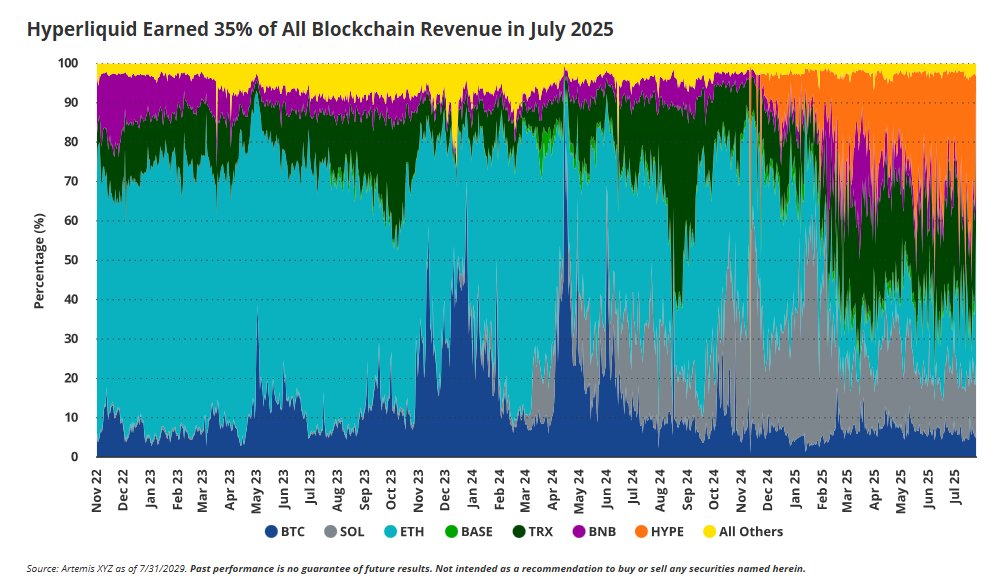

In July, Hyperliquid gained 35% of all blockchain revenues, and achieved sure prices for Solana and the expansion of Ethereum and BNB chains, Vaneck researchers wrote of their month-to-month Crypto Recap report.

“Excessive lipids have been capable of seize Solana’s momentum, and maybe Solana’s market capitalization, as a result of it affords a easy, extremely useful product.”

“Hyperliquid poaches and holds high-value customers of Solana.”

Whereas Solana suffered from reliability points and was unable to satisfy the manufacturing deadline for core software program upgrades, Hyperliquid is making the most of these weaknesses by offering a superior person expertise in spinoff buying and selling.

“Solana has not made any significant enhancements to boost the person expertise, significantly in everlasting futures (PERP) buying and selling.

Excessive lipids earned greater than a 3rd of all blockchain revenues in July. sauce: Vaneck

A speedy enhance in open curiosity in excessive lipids

In a e-newsletter seen by Cointelegraph, he reported that “excessive lipids have emerged as the principle Perps venue for Onchain Perps.”

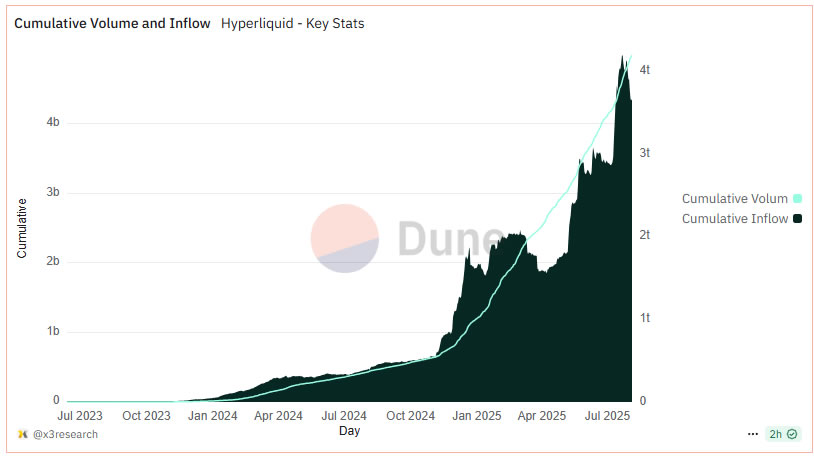

Open curiosity reached $15.3 billion in July, a rise of 369% because the begin of the yr, including that it has embedded greater than $5.1 billion in USDC (USDC).

The combination of Phantom Pockets, which affords in-app Perps, promoted excessive lipids in July with a quantity of $2.666 billion, a $1.3 million charge, and 20,900 new customers.

Associated: Hyperliquid will refund Crypto merchants $2 million after API suspension

Crypto Perpetual Futures is a spinoff settlement that permits merchants to deduce in regards to the value of cryptocurrency with out expiration date.

Excessive lipid accumulation and inflow. sauce: Dune evaluation

Hype value reached an all-time excessive in July

The platform’s native tokens (hype) additionally just lately recovered, hitting a document excessive of $49.75 on July 14th, from the April 14th low.

Compared, Solana’s native tokens (SOLs) have misplaced 44% since their all-time excessive in January. This was primarily pushed by Memecoin Frenzy.

Hype had dropped 3% at $37.38 on the time of writing on the broader market retreat.

journal: As salt merchants brace at a ten% drop, ether might “rip” like in 2021: Company Secrets and techniques