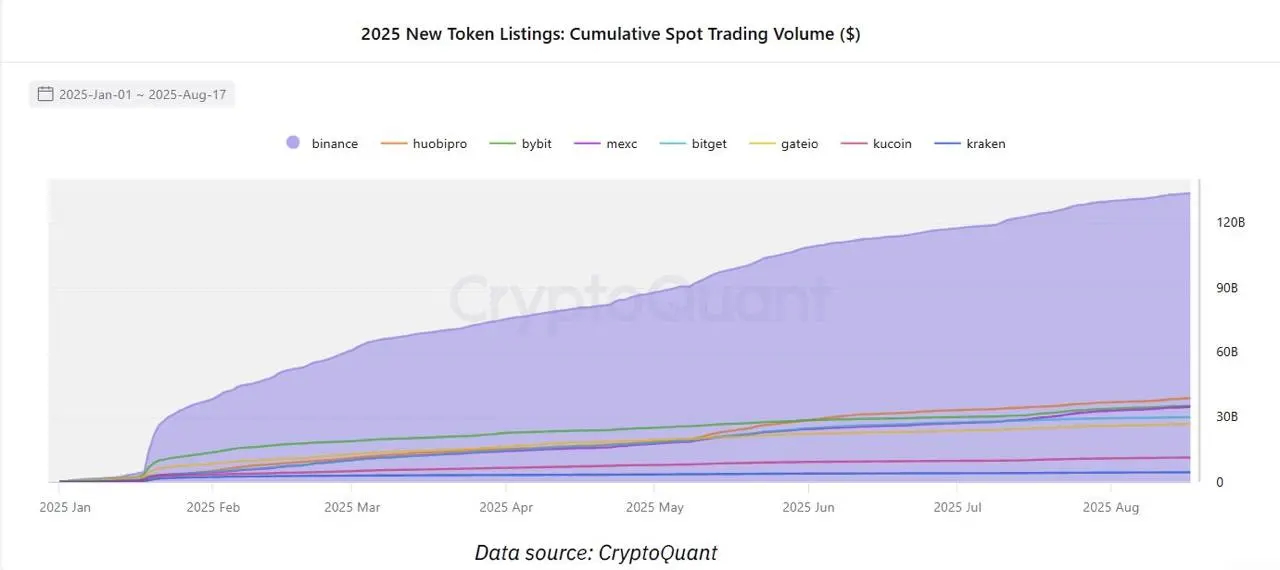

Binance has seen greater than $133 billion in cumulative buying and selling volumes for newly listed tokens in 2025. The encrypted report highlights how exchanges solidify their greatest place on the planet.

In line with information shared by Crypto analyst Onchaindatanerd, Binance stands head and shoulders above all different Crypto Exchanges, accounting for extra buying and selling quantity than the subsequent high three exchanges.

Encrypted information reveals that Binance noticed $133 billion in buying and selling quantity for brand spanking new tokens this yr. Compared, HTX has second place with $38 billion, BYBit has $35 billion and MEXC has $34 billion.

2025 New Token Checklist Spot Buying and selling Quantity (Supply: Onchaindatanerd).

Onchaindatanerd identified that Binance’s giant volumes imply the variety of merchants flocking to trade newly listed tokens, a present of confidence within the liquidity of the trade in comparison with different exchanges.

They wrote:

“This clear management confirms #Binance because the main vacation spot for merchants on the lookout for early entry and excessive liquidity.”

Curiously, cumulative quantity isn’t the one space the place exchanges are higher. It additionally has a giant lead in day by day buying and selling volumes, peaking day by day volumes of round $1.1 billion newly listed tokens over the previous month.

This explains why the trade has a dominant market share because of the day by day buying and selling quantity of recent tokens 3 times increased than the amount of different exchanges. Market share peaked at 54% on July tenth, however fell to about 34% by August thirteenth. Even at that degree, it was increased than the HTX and MEXC ranges of twenty-two% and 15% respectively.

Binance Information Open curiosity in ETH futures in 2025 $4 trillion

In the meantime, the huge quantity of newly listed tokens is simply a part of Binance’s management. Alternate domination is not only about spot buying and selling because it attracts extra spinoff buying and selling actions and demonstrates its standing as one of many high places in the way forward for ETH.

Open curiosity in ETH has skyrocketed in Binance as tokens gained momentum and vital will increase in worth. Between early April and the current, the trade noticed an extra $10 billion in open curiosity, which was added to $2.8 billion afore.

With ETH’s rising open curiosity, Binance has set a brand new document of buying and selling quantity. Notably as a result of it attracts a good portion of the liquidity of the derivatives market. That is greater than what concentrated rivals like BYBIT and OKX, or decentralized platforms like HyperLiquid see.

The trade has already set an all-time excessive in 2025 as a consequence of ETH open curiosity, surpassing $4 trillion this yr alone. That was over $3.7 trillion in 2024, and earlier than the tip of the yr, the trade is on observe to make sure that ETHAN achieves open income in its $6 trillion ETH futures.

BNB will attain new highs as Binance continues

Binance maintains a major majority of market share in each the spot and derivatives markets, so BNB tokens are among the best performances of the present crypto cycle. In line with CoinMarketCap, BNB has gained 21.96% this yr and is at the moment buying and selling at $861.91.

The token lately hit a brand new all-time excessive of $882.58 and seems to be ready to achieve $1,000 within the present cycle with its robust efficiency and resilience. Technical dealer Ali Martinez famous that BNB’s efficiency is linked to Binance actions and that exchanges have grow to be locations for giant cash merchants.

He mentioned Binance recorded $698 billion in spot buying and selling in July, up 61% from the earlier month. Technical analysts mentioned the trade at the moment holds practically 40% of the general centralized trade market, with its market share about 4.5 occasions increased than its closest rivals.

Such numbers imply that the trade has a deeper ebook and fewer slippery, however it’s extra more likely to proceed to draw extra customers than different exchanges.