Credit score Karma Evaluate

free

- Charge

- Credit score Accuracy

- assist

abstract

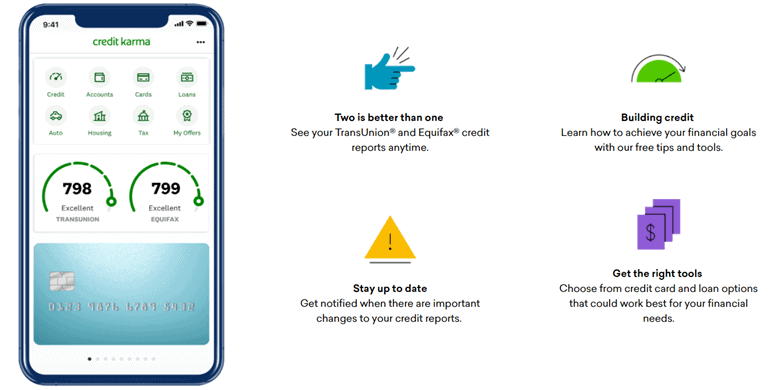

Examine your credit score rating totally free with Credit score Karma and get suggestions on growing your rating!

Robust Factors

- Free credit score monitoring

- Consumer-Pleasant Interface

- Every day Credit score Rating

- Personalised Suggestions

- Excessive-yield financial savings account

Cons

- Solely 2 or 3 credit score bureaus are included

- VantagesCore as an alternative of FICO rating

- Restricted entry to credit score report

- Third-party advertisers create cluttered interfaces

Credit score Karma’s providers assist customers keep updated with their present monetary place and supply helpful sources and personalised tips about enhancing their funds and credit score scores.

Use providers like the next Credit score Karma It is a good way for anybody who needs to construct or keep a superb credit score rating.

Nonetheless, it’s possible you’ll wonder if credit score karma is the most suitable choice to enhance your credit score this yr.

Learn my credit score karma critiques and proceed to be taught why many individuals depend on credit score karma to observe their credit score scores and get nice monetary recommendation.

Credit score Karma Evaluate: Key Takeout

- Credit score Karma offers free credit score scores and credit score experiences with data that Equifax and Transunion present for his or her scores.

- Is credit score karma free? Sure, it is actually free! Is Credit score Karma secure? Double, sure – that is why we use it.

- The corporate has over 130 million members, serving to individuals perceive their funds and credit score historical past.

- It offers beneficial perception into components that have an effect on your credit score rating, similar to your fee historical past, age and variety of credit score accounts, and credit score utilization.

- Arrange authorities assist and use your credit score builder account to higher handle your cash.

- The platform makes use of your profile to view curated gives and supply instruments to enhance your funds and credit score.

- Credit score Karma Cash Spend is a checking account choice that enables customers to handle their cash and observe their spending.

- Credit score Carmamanae Save is a high-yield financial savings account that lets you earn extra money by your financial savings.

What’s Credit score Karma?

Credit score Karma Based in 2007, Credit score Karma turned the department of INTUIT, with individuals serving to us with our taxes!

With over 120 million members, Credit score Karma helps individuals acquire perception into their funds and credit score.

The corporate first aimed to offer shoppers with free entry to credit score scores and experiences.

In the present day, Credit score Karma is not only a stopover to give you a rating.

Credit score Karma instruments assist shoppers enhance their credit score reporting, together with personalised suggestions for enhancing scores.

You will get each your Equifax and Transunion credit score scores and what’s holding you at bay.

You may also get alerts for necessary adjustments to your credit score limits and credit score scores, in addition to gives curated based mostly in your credit score profile.

Most important options and monetary merchandise

these Credit score Karma The characteristic offers the knowledge and instruments it’s good to make higher selections about your monetary future.

And these monetary merchandise will make managing your cash a lot simpler!

Let’s check out among the main credit score karma options and monetary merchandise that stand out from different credit score providers.

Credit score Monitoring

One of the vital necessary options of credit score karma means is Monitor your credit score rating Free.

This consists of Equifax and Transunion scores up to date each 7 days, permitting you to observe necessary adjustments in actual time.

Not solely does this enable you monitor your total credit score well being, but it surely additionally helps you discover extraordinary actions and take motion rapidly when wanted.

You may also test components that have an effect on your rating, similar to your mortgage quantity and fee historical past, to higher perceive the way it works.

Credit score Report

Credit score karma additionally reveals what’s affecting your credit score Detailed Credit score Report From two of the three main credit score bureaus, Equifax and Transunion.

One of many nice issues about credit score karma is that it is easy to grasp credit score experiences.

They break down every part and clarify what it means to your total rating.

Moreover, it offers helpful ideas for enhancing every side of the report, similar to debt repayments and dispute errors.

When you’ve got any questions, our customer support group is accessible.

Common updates in your credit score karma credit score rating will enable you keep in contact extra incessantly.

You possibly can obtain alerts if there are adjustments to the report, similar to new public accounts or missed funds.

This lets you know your credit and take actions everytime you need.

Credit score Rating Simulator

Have you ever ever questioned how a selected motion impacts your credit score rating? No want to look anymore Credit score Karma Credit score Rating Simulator.

Simulators are instruments that can help you discover totally different situations and see how they have an effect on your rating.

Whether or not you are contemplating paying off your debt, paying off your automobile mortgage or opening a brand new bank card, simulators can assist you make knowledgeable selections.

You will need to do not forget that the outcomes offered by the simulator are estimates reasonably than predictions.

Nonetheless, this software can present beneficial perception into how totally different actions have an effect on credit score scores at totally different credit score reporting businesses.

Credit score Builder (Mortgage)

Are you struggling to construct a credit score rating? There isn’t any different program besides Credit score Karma’s Credit score Builder.

You possibly can apply for an interest-free mortgage so you’ll be able to construct your credit score and lower your expenses on the similar time.

Primarily, begin with a $500 aim with out a month-to-month charge and use your credit score builder as a financial savings spot.

Resolve how a lot you can be on the mortgage, whether or not it’s weekly, each different week, or month-to-month.

If you pay for them, that cash is left behind and this units you as much as acquire observe report of creating you a greater historical past.

Credit score Karma says you’ll be able to enhance your rating by a median of 21 factors in simply 4 days!

Credit score Carmamana

Credit score Karma Present new cash expertise with Credit score Carmana accounts.

Financial institution accounts have FDIC insurance coverage as much as $250,000, so customers can really feel safe that their cash is secure even within the recession.

Your account comes with 24/7 buyer assist, so in case you have questions on your account, you do not have to fret about leaving your clients at midnight.

It gives two financial institution accounts to benefit from your cash – Credit score Karma Cash Expenditure and Credit score Karma Nae Save:

Credit score Carmana Price Account

Credit score karma cash is spent That is a web based checking account that may be opened 100% free, with no overdraft charges or penalties.

Overdraft charges are a giant recreation chapter for these dwelling payroll who’re anxious about when the subsequent invoice shall be a success.

Plus, you’ll be able to take pleasure in free withdrawals and you may’t fear about sustaining your lowest stability on this checking account.

With this checking account, you’ll be able to take pleasure in free withdrawals at over 55,000 ATMs nationwide.

Moreover, in the event you get hold of a Visa® debit card, you’ll be able to earn cashback rewards in your chosen debit purchases, permitting you to construct low credit whereas saving cash.

That is a bonus for each events!

Credit score Carmamana Save – Excessive Yield Saving (HYSA)

Credit score Carmamana Save There are not any aggressive rates of interest and month-to-month charges.

This enables customers to simply lower your expenses with out worrying about hidden charges or low return on funding.

Credit score Karma’s HYSA presently gives greater than 10 occasions the nationwide common (4.10% vs. 0.4%).

Moreover, there isn’t a charge and minimal stability requirement in order that anybody can use a financial savings account with bank card carmanaee.

Tax Software program

Are you a Credit score Karma member making an attempt to file your taxes? You’re fortunate as Credit score Karma gives tax functions Turbotax!

Turbotax is a paid service for submitting taxes, however gives reductions and coupons, and a few individuals are eligible totally free submission!

you Eligible totally free submissionTurbotax offers step-by-step steerage all through the method and helps be sure that taxes are finished accurately.

Moreover, with TurboTax, you may get the biggest refund potential by figuring out deductions and credit you could have missed.

To make use of this service, it’s essential to electronically examine your federal tax return with TurboTax and maintain or open a Credit score Karma Cash Spend account.

Utilizing Credit score Karma tax returns by Turbotax nonetheless has benefits, primarily because of nice critiques from different customers.

If you want to make use of Credit score Karma tax returns by way of TurboTax, please rigorously test the phrases earlier than continuing.

And remember to gather all of the monetary paperwork you want upfront. That manner, remember that the method will go easily.

Mortgage Market

Do not understand how a private mortgage works or is it appropriate for you? Credit score Karma Right here you’ll be able to assist with a easy mortgage calculator.

Credit score Karma gives Mortgage Market You possibly can examine costs from the highest render.

You may also apply on-line instantly. You may also put all the main points and data you want in a single place.

Credit score Karma gives a wide range of monetary merchandise, together with private loans, automobile loans, bank cards, and insurance coverage providers.

Credit score Karma’s mortgage market gives not solely comfort however peace of thoughts when many choices.

This platform will enable you view a wide range of mortgage choices and determine which one fits your wants.

Whether or not you are in search of debt compensation calculator, bank card repayments, or financing your giant purchases, Credit score Karma has yours coated.

Moreover, critiques from varied lenders on the location permit customers to make knowledgeable selections about which lenders they select to swimsuit their private mortgage wants.

ID monitoring

Are you anxious about identification theft? It is easy to really feel susceptible as a lot of our private data is on-line.

Hey, don’t be concerned! Credit score Karma has your again with them Free Id Monitoring Software.

What precisely is ID monitoring? Primarily, it’s a service that displays your private data and warns you within the occasion of one thing suspicious, similar to identification theft.

You possibly can’t test each bank card and each electronic mail on daily basis to ensure the whole lot is added and there is nothing suspicious occurring.

Credit score Karma can observe issues like this for you and take away one other one out of your plate!

Their theft monitoring consists of critiques of latest accounts, new bank cards printed beneath your title, or adjustments to credit score experiences that don’t match regular actions.

Moreover, Credit score Karma’s free ID monitoring alerts you in case your private data is concerned in an information breaches or different safety incident.

Reduction Roadmap

The financial impression of the coronavirus pandemic is affecting everybody. Fortunately, Credit score Karma created one thing personalised Reduction Roadmap.

This free software is designed to offer the assist you want throughout these difficult occasions.

This may enable you join with authorities stimulus applications, debt reduction alternatives, mortgage choices, and different helpful monetary instruments.

The reduction flooring map is straightforward to make use of and is tailor-made to your particular wants and monetary state of affairs. This actually helps households throughout troublesome occasions.

Whether or not you are in search of data on the best way to apply for presidency help or need assistance managing your debt, the reduction roadmap is roofed.

Simply reply a couple of questions on your monetary state of affairs and Credit score Karma gives a personalized motion plan.

Authorities Assist – Early Entry

If you’re taking part in a authorities assist program and are ready for the cash to strike the financial institution, credit score karma can assist it arrive earlier.

To qualify, it’s essential to get hold of funds from Social Safety, VA advantages, or Supplementary Safety Revenue (SSI).

Get a Credit score Carmana Account, arrange a direct deposit and hyperlink with authorities paperwork.

As soon as Credit score Karma receives affirmation from the federal authorities, you may get help as much as 5 days upfront.

These few days could make all of the distinction for many individuals, and it is likely one of the greatest new options.

Charge

Are you questioning about the price of utilizing credit score karma? Effectively, the excellent news is that it is fully free!

Sure, you learn it accurately. Credit score Karma doesn’t cost you for the service. As you’ll be able to see, there are many options to make it fully free.

Entry your credit score experiences and scores from Equifax and Transunion with out paying Dime and obtain recommendation that can enable you with your individual monetary state of affairs.

Different Credit score Rating Apps

different Credit score Rating App Different monetary apps present credit score scores, budgeting, mortgage data, and HYSA.

Let’s take a better have a look at the others Cash Administration App It might enable you along with your cash, credit score rating, and so on:

Credit score Sesame

Credit score Sesame One other different to monitoring your credit score rating that emphasizes identification theft safety and offers tailor-made monetary recommendation.

Credit score Sesame gives free Experian scores, Vantage 3.0 credit score scores, month-to-month up to date, every day monitoring of your account, and real-time alerts when suspicious exercise is detected.

It additionally consists of instructional sources similar to weblog posts and movies on budgeting and debt administration, permitting customers to be taught extra about nice monetary practices.

One of many main attracts to Credit score Sesame is identification theft insurance coverage. This covers as much as $50,000 in identification theft instances.

chime

chime If you wish to get extra with a high-yield financial savings account, this can be a sensible choice.

Chime is a monetary expertise firm that gives revolutionary options that can assist you handle your funds.

One of the vital in style options is the Chime FICO Rating Program. This lets you observe your credit score scores totally free throughout the Chime app.

Along with credit score constructing instruments, Chime gives excessive yield financial savings accounts (HYSAs). 2.0% Annual Yen Yield (APY).

This implies you’ll be able to earn curiosity in your financial savings with out worrying about month-to-month upkeep charges or minimal stability necessities.

Learn the total particulars Chime overview right here.

Greatest On-line Banking Alternate options

chime

There isn’t any value to a checking account. Chimes have a again with out month-to-month charges, so you’ll be able to construct credit and extra.

Begin saving now

FAQ

Is Credit score Karma secure?

The excellent news is that Credit score Karma It’s a respectable and safe service to make use of.

There are round 130 million credit score karma members, however nobody will stick with it except it’s secure to make use of.

They use trade customary safety measures to encrypt and Two-factor authentication.

They’re additionally not simply make numbers which have your credit score rating and historical past coming from two main credit score bureaus!

Moreover, they don’t promote your data to 3rd events. Every thing stays between you and your credit score karma.

Is credit score karma free?

The reply is sure! Credit score Karma gives free scores and experiences on credit score historical past from 2/3 credit score departments, Transunion and Equifax.

You should use the Credit score Karma app to see your rating wherever you might be.

Along with this, we additionally present a wide range of instruments and sources that can assist you enhance your credit score rating and handle your funds.

How correct is my credit score calmas rating?

Is your credit score karma credit score rating correct? It is dependent upon a number of components, together with the completeness and accuracy of the knowledge within the report.

If there may be error or lacking data within the report, it might probably have an effect on your rating and the lender sees it isn’t the identical. Particularly in case you have details about all three credit score bureaus!

Every lender might use a unique scoring mannequin or have an inside scoring system.

So, your credit score calmascore could also be nearer to what a lender sees when drawing your full credit score report, but it surely doesn’t assure that it’s the similar.

How does credit score karma work?

Credit score Karma makes use of two of the three main credit score departments to acquire credit score. These numbers come from TransUnion and Equifax.

Credit score Bully tracks your money owed with bank cards and loans. All of that is credit score scoring.

This rating additionally is dependent upon what number of credit you will have and the way a lot you will have/unused out of your credit score stability.

Not solely can you retain up along with your credit score rating, you can even work on the best way to pay it off and enhance your rating utilizing their debt compensation calculator.

How does credit score karma earn a living?

Credit score Karma makes cash by partnering with monetary establishments to offer customers with personalised loans and bank card suggestions to their companies.

When a consumer applies for a really helpful product by Credit score Karma, Credit score Karma will fee from Credit score Karma companions.

That is just like a weblog or online marketing hyperlink, or an influencer’s hyperlink to an Amazon product or different neat factor.

Along with these partnerships, Credit score Karma gives paid providers similar to tax preparation and identification theft safety.

These providers are non-obligatory for customers, however can present further income to the corporate.

Why do totally different apps give me totally different credit score scores?

When you’ve seen your credit score rating on a number of apps or web sites, every will present a barely totally different quantity.

You will need to perceive that there are a number of several types of credit score scores. The FICO rating is probably the most generally used sort within the vary of 300-850.

Nonetheless, there are different scoring fashions, similar to VantagesCore and Transunion CreditVision, and select what your credit score and mortgage enterprise makes use of.

Every scoring mannequin calculates the rating utilizing barely totally different algorithms. Which means numbers might range relying on the mannequin used.

Moreover, every app or web site can extract data from totally different credit score businesses (Experian, Equifax, or Transunion) that have an effect on your rating.

Are Credit score Karma accounts beneficial?

In my view, the reply is sure! When you’re in search of a free technique to monitor your credit score scores and experiences, we suggest making an attempt Credit score Karma.

We have been utilizing credit score karma for years and we love the options they provide.

Straightforward-to-read experiences from credit score bureaus similar to Transnion and Equifax, and credit score rating enchancment instruments have modified private funds.

You may also contemplate certainly one of them The very best credit score constructing app That is since you can provide you adjusted solutions that can enable you get a better credit score rating.

My ideas

Credit score Karma It’s a very handy service for many who need to use a free credit score report and contemplate their monetary place intimately.

Another websites cost comparable providers, however credit score karma is free!

It offers beneficial perception into present monetary state of affairs and academic sources that can assist everybody perceive the fundamentals of credit score scores and the best way to price range.

They need to enable you management your cash and need to ensure your cash rises greater than it drops.

So in the event you’re in search of a straightforward technique to monitor your funds whereas gaining data alongside the way in which, positively give it a strive on Credit score Karma!