What simply occurred? A brand new monetary market goals to supply essential threat administration instruments to a useful resource on the middle of the tech trade’s explosive development. If profitable, the initiative may make entry to high-performance compute extra predictable and inexpensive.

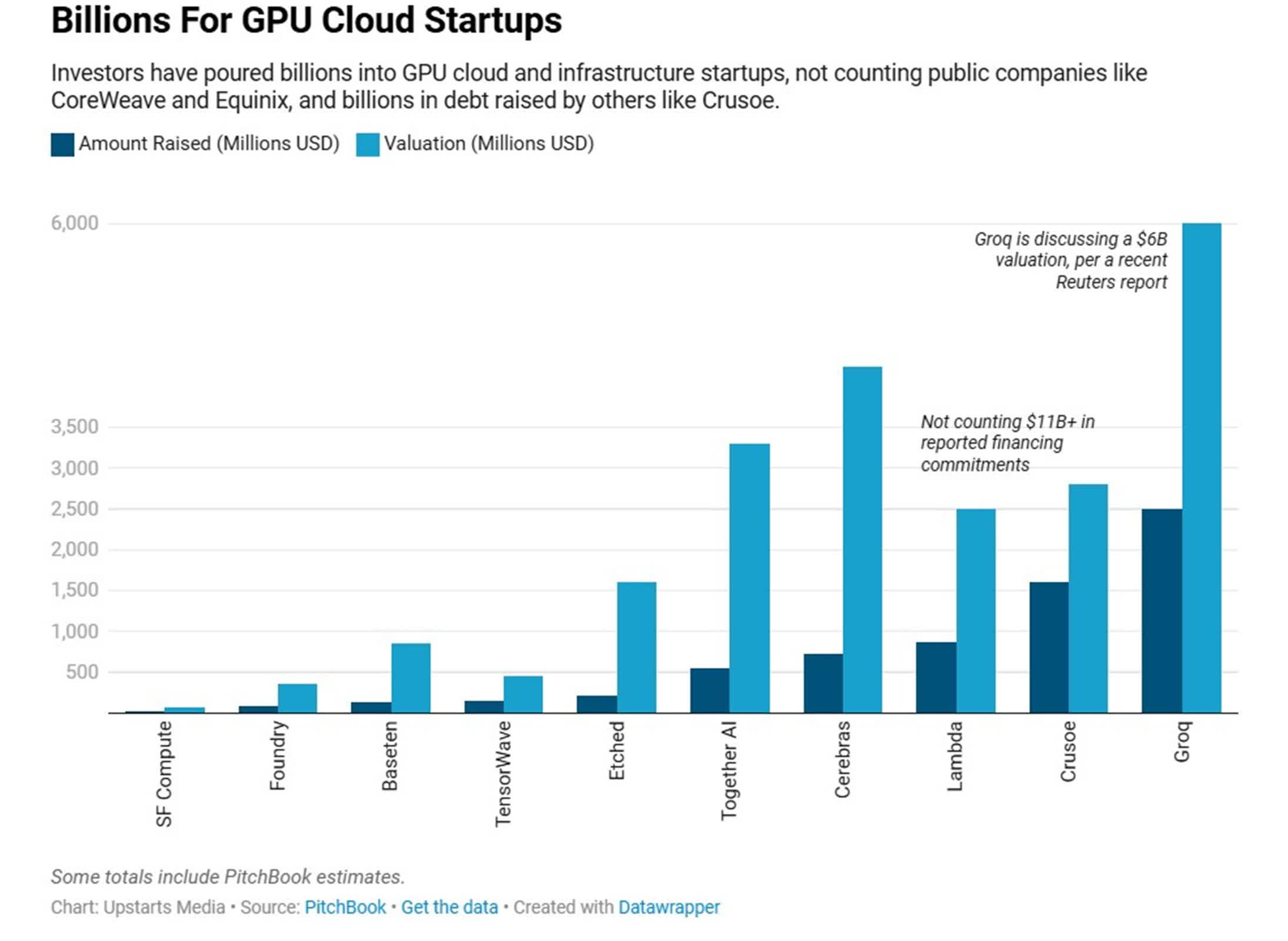

The world of synthetic intelligence is constructed on computing energy, and on the coronary heart of that engine are graphics processing items. These chips are in such excessive demand that they’ve usually been in comparison with oil throughout the gold rush, driving the worth of firms like Nvidia effectively into the trillions and pushing tech giants to announce investments value a whole lot of billions in AI infrastructure. But, for all their significance, GPUs have remained stubbornly exterior the attain of one in every of finance’s core mechanisms: the power to hedge, lock in costs, and commerce futures on the very useful resource on which so many firms rely.

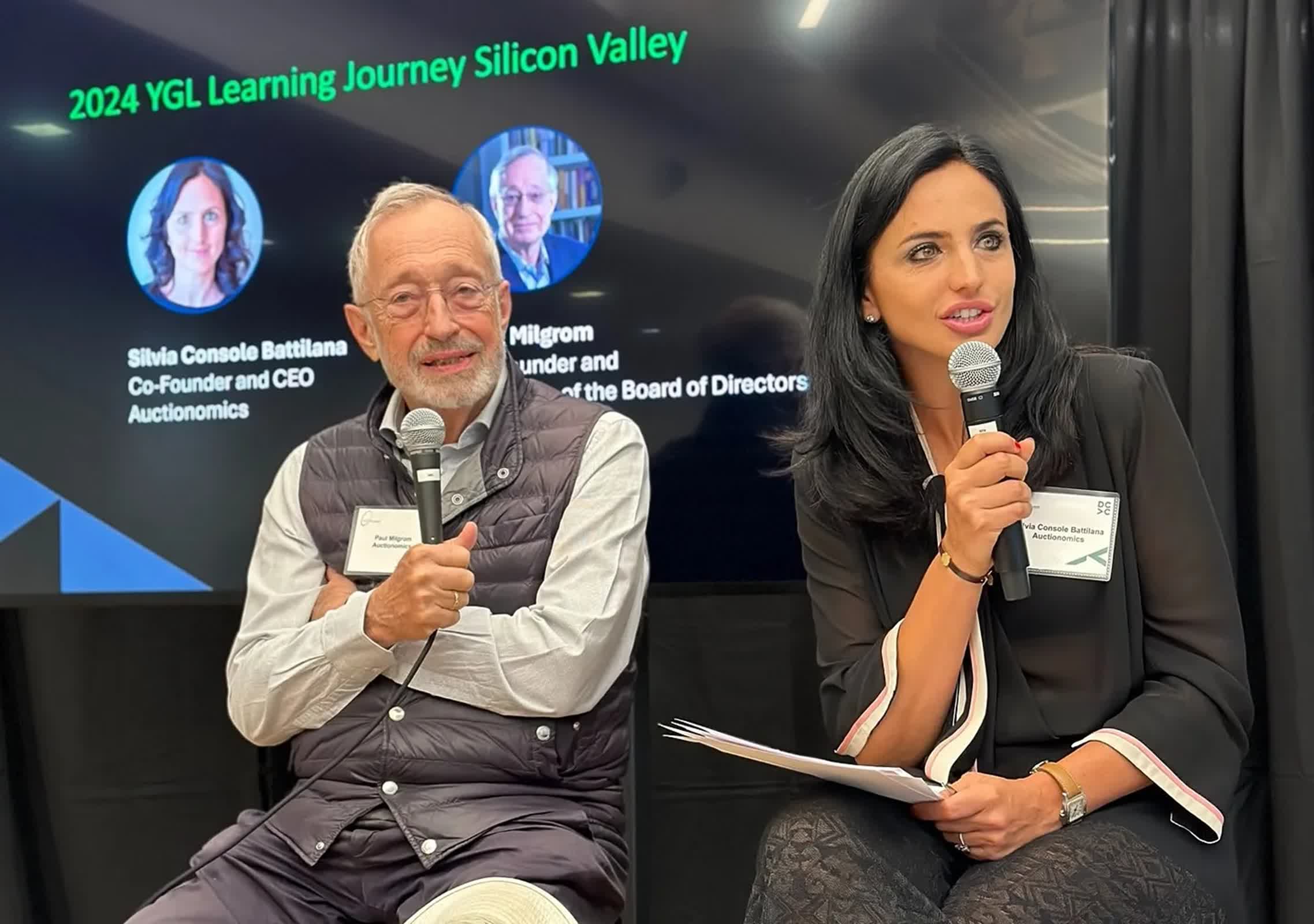

That will quickly change. Startup OneChronos has partnered with Auctionomics, a market design agency co-founded by Nobel Prize-winning economist Paul Milgrom, to launch the primary organized monetary trade for GPU compute. This new market is designed to let individuals purchase and promote entry to GPU assets in a fashion much like commodity futures, addressing continual shortages and worth spikes which have lengthy pissed off AI builders.

Whereas markets for commodities like electrical energy and cocoa have existed for years – enabling producers and shoppers to invest, hedge, and handle threat – the identical has not been true for GPU compute, regardless of its centrality to AI’s explosive development. “GPUs are about to be the biggest unhedged company asset class on the planet,” Kelly Littlepage, CEO of OneChronos, informed Upstarts Media. He argued that whereas oil and energy are routinely hedged “all the way down to the penny,” GPUs have to this point lacked the same monetary toolset.

OneChronos initially made its mark with so-called sensible markets – superior auctions that deal with massive, advanced transactions. Its current buying and selling system for US equities handles $6.5 billion in day by day quantity. However Littlepage described this as merely a place to begin for what he calls “the bazaar for the AI brokers of the long run” – a imaginative and prescient that has now drawn the experience of Auctionomics, whose market designs have delivered billions in financial savings and helped reshape industries from telecommunications to tv streaming.

“We’re not fully reinventing the wheel,” Milgrom mentioned. “It is serving to folks monetize their stock, finance their investments, and handle their threat.” The brand new platform goals to just do that for the GPU market, which has seen demand outpace provide as AI workloads skyrocket, leading to hovering rental costs and chronic bottlenecks for each startups and analysis establishments.

The system is ready to function by means of common auctions, the place firms can bid on GPU time slots or capability. It holds the potential for a brand new diploma of worth discovery, threat administration, and liquidity in computing assets. In keeping with Silvia Console Battilana, co-founder and CEO of Auctionomics, a lot of the behind-the-scenes work has concerned standardizing precisely what’s being purchased and offered. “We spent a number of our time defining what is precisely on the market,” Console Battilana mentioned. Milgrom described their resolution as a carefully guarded “magic sauce.”

If the undertaking succeeds, it may carry quite a few advantages: startups may acquire extra inexpensive and dependable compute for AI coaching or analysis, whereas infrastructure operators may finance new capability or unload extra assets extra effectively. The objective is to permit a broader vary of individuals – knowledge middle operators, chip producers, institutional consumers – to lock in pricing, handle publicity, and higher plan for the long run.

Nonetheless, the street forward is steep. For GPU compute to grow to be a really tradable commodity, {the marketplace} will want broad participation, from dominant chip makers like Nvidia to cloud giants and rising knowledge middle suppliers. OneChronos and Auctionomics are at present in dialogue with a number of stakeholders throughout the trade. “We predict there’s some curiosity on this from the broad ecosystem, and the extra range of individuals now we have, the higher and more healthy the market might be,” OneChronos co-founder Stephen Johnson mentioned.

Milgrom, reflecting on the importance of the initiative, likened the second to early developments in agricultural markets: “Markets evolve and develop new capacities to assist new financial actions.” The comparability is apt, as the brand new trade goals to do for AI compute what railroads and futures contracts as soon as did for wheat – unlocking development by making vital assets actually tradable.

Picture credit score: Upstarts Media